FSD Pharma (NASDAQ: HUGE) (CSE: HUGE) has an interesting symbol: HUGE. Based on its progressing product pipeline, it’s fitting. Why? Because this company is tapping into at least two markets that can generate massive shareholder value. More importantly, that’s a near-term expectation, exposing a valuation disconnect between assets, potential, and a share price that may be too vast to ignore.

Many investors aren’t. Trading volume reached its highest level since August 2023 last Tuesday, churning throughout the day to close at $0.82. Since then, the volume has stayed elevated, higher than the roughly 107k average skewed higher after scoring a 1.9 million shares-traded-day last week. That interest helped HUGE stock increase by approximately 4.8% to close the trading week. While an impressive gain, tangibles and forward-looking potential should continue contributing to an already compelling case for a more appreciable move higher.

In other words, the case is evidence-based. Thus, despite the move higher, and considering the value drivers in play, significant upside may be more than warranted; it’s justified.

Value Drivers Support Near-Term Appreciation

Those drivers include a compelling early-stage clinical program, LUCID-MS, to treat Multiple Sclerosis and interest in a game-changing “rapid alcohol detoxification” product, UNBUZZD™. Both present compelling opportunities, and while investors should familiarize themselves with both, the latter is the near-term value driver that investors shouldn’t ignore, underappreciate, or undervalue.

Why? Because UNBUZZD™ is a revolutionary product. As importantly, it’s being managed and marketed by a Who’s Who list of beverage industry veterans, including brand marketing partner Celly Nu CEO John Duffy, a seasoned industry executive with over thirty successful years of experience in sales leadership, revenue growth, strategy optimization, administration, customer development, and operations. Most recently, John was Co-Founder, EVP, and Chief Commercial Officer at Legends Access LLC with partner and NFL Hall of Fame member Ray Lewis, where he created and managed Legends influencer, social media, and e-commerce platforms and developed partnerships with new clients, including MillerCoors (NYSE: TAP), UPS (NYSE: UPS), and Capital One (NYSE: Capital One Financial: COF). Before that, he held leadership positions with LA Libations (a next-generation beverage incubator), JJ Taylor Distributing, and 22 years at Coca-Cola (NYSE: KO), including Vice President of Marketing Assets and Vice President of National Sales. In short, he’s an industry superstar.

He’s not a one-person show, either. He’s supported by marketing and operation leadership that’s equally impressive, including Halley Lorber and Peter Slauer, both with decades of experience working with brand powerhouses like Frito Lay (NYSE: PEP) and Keurig, helping them generate billions in value through brand development and acquisitions. Of course, investors should embrace the value contribution. More significantly, they should understand why they joined Celly Nu. That answer is becoming more apparent by the day: UNBUZZD™ is the best choice in an emerging beverage segment market where the spoils of leadership can be worth billions.

UNBUZZD™ Checks More Boxes

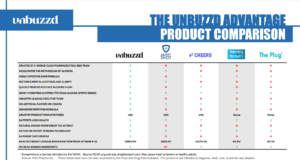

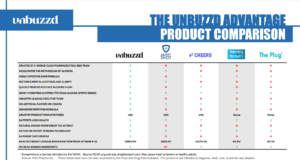

Comparisons to other brands trying to carve out their share of that potential show why UNBUZZD™ and the team behind it are the ones to back. The list is vast and shown below. What’s clear, however, is that UNBUZZD™ checks boxes others can’t, spearheading a go-to-market strategy that should make the product available nationwide starting this year.

And not just on retail shelves. Distribution agreements can help HUGE benefit from product placements in the hospitality and eCommerce sectors, including on Amazon (NASDAQ: AMZN) and potential deals expected from behemoth retailers like Walmart (NYSE: WMT), CVS (NYSE: CVS), and Target (NYSE: TGT). Earning those placements is an expectation rather than a wish. According to HUGE, they will earn them through engaging the growing consumer demand from socially conscious adults who want to drink responsibly and wake up feeling refreshed. Partnerships with BevSource, Six+One, and More Molecule LLC can expedite that intention.

By successfully executing its plan, HUGE will tap into a global hangover cure products market that Grand View Research valued at $2.05 billion in 2022. However, while a significant and virtually untapped opportunity then, it’s gotten more substantial. Growing at a compound annual growth rate of 14.8% to the end of this decade, the revenue-generating opportunity becomes a far more significant $6.2 billion. Reaching just the US-based customer delivers a prize worth targeting. Grand View Research pegs the U.S. hangover cure products market size at $393.2 million in 2022, expecting it to surge to $1.15 billion by 2030.

However, that valuation may prove conservative, noting that U.S. consumer demand for “functional beverages” is soaring, as evidenced by the $141 billion functional beverage segment and $53 billion dietary supplements market. Factoring those markets into the equation, the sales opportunities in play for UNBUZZD can be far higher than its primary target market, the “hangover cure products market”, suggests. More simply, by selling into multiple verticals, the sales growth trajectory for UNBUZZD™ could be exponential.

Forecasting For Significant Growth

The team behind its launch thinks so. They forecast 2024 revenues to reach about $1.6 million. From there, they expect YoY revenues to grow 287% in 2025, 176% in 2026, and 141% in 2027, leading to expected sales of over $41 million by the end of that period. As critical to the topline growth, the bottom line is expected to produce operating profit in 2026, followed by a 2027 forecast to drop roughly $13 million to the bottom line as scale efficiencies take root.

There are reasons for the company and its investors to be bullish about the opportunity. Foremost is that UNBUZZD™ statements to the FDA have not been objected to. That’s a big deal because they say quite a lot and make an excellent case for why it is a better segment product. Statements include:

- “Product restores mental alertness”

- “Product promotes mental health”

- “Product promotes alcohol metabolism by the body’s natural dehydrogenase liver enzymes”

- “Product accelerates the metabolism of alcohol by ADH and ALDH”

- “Product replenishes cofactors necessary for alcohol metabolism by the liver enzymes”

- “Product replenishes cofactors necessary for alcohol metabolism”

- “Product enhances mental alertness and replenishes cofactors for alcohol metabolism”

- “Product enhances mental alertness and accelerates the rate of alcohol metabolism”

- “Product supports faster recovery from alcohol inebriation”

Keep in mind that the FDA is not a forgiving agency when it comes to inaccurate marketing. Thus, an accurate appraisal of HUGE must include the value of comparative advantages, which in this case are differences that can position UNBUZZD™ as an undisputed market leader. Yes, there’s competition. However, looking at the brand comparable graphic above, UNBUZZD™ may be the best product to exploit the market opportunity from a best-in-class distinction.

A Value Proposition Exposed

If so, HUGE’s current valuation could be a springboard, not a pedestal. Moreover, with only about 39 million shares outstanding and significant insider ownership reducing the trading float to roughly 33 million, incremental news of market penetration may be plenty to fuel an increase in HUGE’s share price. That’s a likely proposition.

Remember, UNBUZZD™ is led by a management and advisory team that has generated billions in value for other brands. For investors, that may be the second best reason to consider seizing the value proposition. The first reason is to stick with best-in-class, a title that UNBUZZD™ can earn as it continues to show comparable distinctions that are too significant for consumers to ignore. And as those get recognized and turn sales ambitions into actuals, the under-the-radar company behind its expected growth, FSD Pharma, may present a value proposition at current prices that, at the cost of sounding repetitive, may also be too palpable to ignore.

Disclaimers: Hawk Point Media Group, Llc. (HPM) is responsible for the production and distribution of this content. Hawk Point Media Group, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media Group, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors do NOT buy and sell securities covered before or after any particular article, report and/or publication. HPM holds ZERO shares and has never owned stock in FSD Pharma. However, it is prudent to expect that those hiring HPM, Llc, including that company’s owners, employees, and affiliates may sell some or even all of the FSD Pharma shares that they own, if any, during and/or after this engagement period. If successful, this advertisement will increase investor and market awareness of FSD Pharma and its securities, which may result in an increased number of shareholders owning and trading the securities, increased trading volume, and possibly an increase in share price, which may be temporary. This advertisement does not purport to provide a complete analysis of FSD Pharma or its financial position. The agency providing this content are not, and do not purport to be, broker-dealers or registered investment advisors. In no event shall Hawk Point Media Group, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media Group, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, HPM, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. Hawk Point Media Group, LLC. has been compensated five-thousand-dollars cash via wire transfer from OEJ Enterprises, Inc. to produce and syndicate content for FSD Pharma for a period of one month beginning on 03/11/24 and ending on 03/17/24. This compensation is a major conflict of interest in our ability to be unbiased regarding our alerts. Therefore, this communication should be viewed as a commercial advertisement only. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. As part of all content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Trendingsmallcaps.com, a leading financial news informational web portal designed to provide the latest trends in Market News, Investing News, in-depth broadcasts on Stock News, Market Analysis and Company Interviews.

Trendingsmallcaps.com, a leading financial news informational web portal designed to provide the latest trends in Market News, Investing News, in-depth broadcasts on Stock News, Market Analysis and Company Interviews.